At this time, there are a set of 241 criteria that flesh out the five pillars of transparency. The “Five Pillars of Transparency” include:

- Accessibility – Readers can quickly find pertinent information in a document and information is presented in a manner that is easy to digest.

- Precision – The disclosure prioritizes thoughtful reporting and includes critical information beyond requirements of compliance that helps readers understand the company.

- Comparability – Information is summarized appropriately and presented in a way that facilitates comparisons across companies and against readers’ own guidelines, criteria and expectations.

- Availability – Readers can easily find the document(s) they want in the format and language they need.

- Clarity – Writing is in clear, plain language so that disclosures are immediately understood by the reader.

The independent Transparency Scientific Committee meets every year to determine what changes should be made to the objective criteria used during the prior year.

If you want to learn more about each of these criteria, we recommend that you sign up to get our blog pushed out to you by email, as we provide practical guidance – and examples of good disclosure – all year long on that blog, by simply inputting your email address into the “Subscribe” form in the right column of the home page of this blog.

Transparency Criteria: 241 Criteria

Here are the 241 criteria that we currently urge companies to use to make their corporate disclosures more transparent (here is a PDF with all of the 241 criteria):

- Proxy Statements (here is a PDF with the 86 proxy statement criteria)

- Form 10-Ks (here is a PDF with the 26 Form 10-K criteria)

- ESG Reports (here is a PDF with the 75 ESG reports criteria)

- IR Websites (here is a PDF with the 25 IR website criteria)

- Codes of Conduct (here is a PDF with the 29 codes of conduct criteria)

A. Transparency Criteria: Proxy Statements

Here is the set of 86 criteria that companies can use to make their proxy statements more transparent:

- The document is available in print PDF format on the Investor Relations webpage.

- The company provides an interactive version with links to navigate to and from sections of the document, including table of contents.

- The company files a courtesy PDF with the SEC.

- The cover includes the time and date of the annual meeting.

- The document includes a secondary color.

- Every page footer or header includes the company name, document title and year and relevant section.

- The table of contents is one-page and includes two levels of hierarchy.

- Voting and general information is presented in Q&A format at the back of the proxy (except in a proxy contest).

- The company explains how shareholders can submit questions for the annual meeting.

- The core proposals (election of directors, say-on-pay and ratification of auditors) precede relevant disclosures.

- The notice of annual meeting is formatted to highlight items to be voted on, voting methods and meeting logistics.

- The document includes an introductory letter providing an overview of the board’s priorities/focus areas from either independent Board leadership or the full Board.

- The mission, vision or purpose of the company is presented within the introductory pages.

- The proxy summary or introductory pages include a table listing the proposals together with the board’s recommendation for each one.

- The document includes a company overview section using graphics or other visual elements.

- An overview of the company’s strategy is presented within the introductory pages.

- The company overview section includes business and financial highlights.

- The proxy summary or introduction to election of directors proposal includes a board summary matrix, table, graphics or other visual elements that names all directors and includes, at a minimum: each director’s primary occupation; age; independence; tenure; and committee membership.

- The proxy summary or introduction to election of directors proposal includes graphics presenting, at a minimum: tenures; genders; and race/ethnicities of the full board.

- The document includes a summary of key governance highlights, practices and/or policies (e.g., what we do/don’t do, best practices list or adoption timeline).

- Each director biography includes a photo and is formatted to highlight skills/qualifications and at least three separately presented attributes (such as tenure, age, independence, other public directorships, and committee assignments).

- Board skills are presented in a matrix or table indicating the skills held by each individual director.

- Board skills are presented in a matrix, table, graphic(s) or using other visual element indicating the skills held by the board in the aggregate.

- The relevance of each board skill and its link to company strategy is explained.

- The document includes a dedicated section, subsection or callout discussing director succession planning/refreshment.

- The document includes a dedicated section, subsection or callout discussing the board’s view on director tenure and/or any retirement age or term limit policies.

- The document discusses considerations for re-nomination of incumbent directors.

- The process for vetting new director candidates is depicted in a graphic or using other visual elements.

- Key aspects of shareholder nomination rights are discussed in the context of other governance policies and practices.

- The document has a dedicated section, subsection or callout explaining the company’s approach to board diversity, including a policy or specific commitments.

- Board diversity information (individual or aggregated) is presented in a matrix or table.

- Board committee responsibilities are presented in bullet format.

- The attendance rate disclosed for the entire board is precise rather than the minimum “more than %” requirement.

- The duties/responsibilities of the Independent Chair or Lead Independent Director (as applicable) are listed in bullet format.

- The rationale and/or qualifications related to selection of individuals currently serving as Chair and/or Lead Independent Director is explained.

- The document includes disclosure on the board’s committee chair rotation and selection process.

- The board’s policies and practices related to director onboarding and continuing education is disclosed.

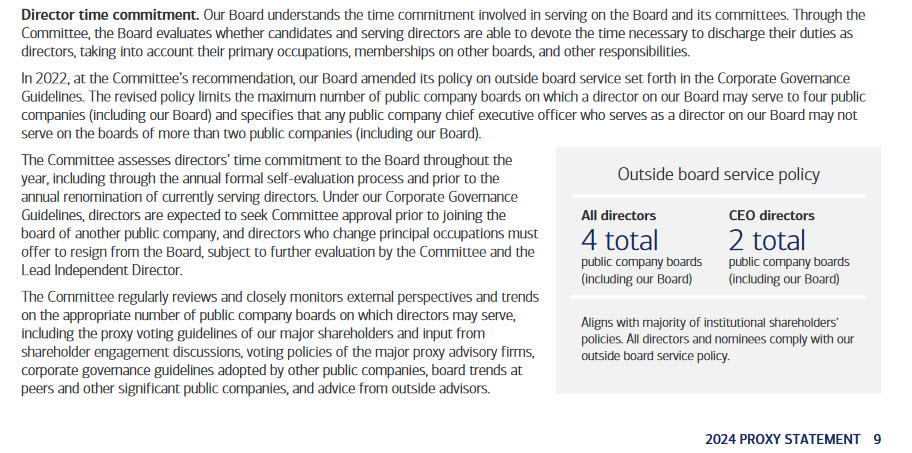

- Policies or processes related to director time commitments are disclosed.

- The board evaluation process is depicted in a graphic or using other visual elements.

- The board evaluation disclosure includes topics assessed and examples of enhancements or actions taken resulting from evaluation feedback.

- The document includes a dedicated section, sub-section or callout discussing the board’s role in oversight of strategy.

- The distribution of specific risk oversight responsibilities among the Board, Board committees, and management is depicted in a matrix, table, graphic or using other visual elements.

- Within the risk oversight section, there is an overview of the enterprise risk management (ERM) process including timeframes for assessing risks (short, medium, long-term).

- The document includes a dedicated section, subsection or callout discussing the board’s role in oversight of information security/cybersecurity/data privacy risks.

- The document includes a dedicated section, sub-section or callout discussing the board’s role in CEO and management succession planning.

- The document includes a dedicated section, subsection or callout discussing the board’s role in oversight of human capital management.

- The document includes a section, subsection or callout discussing the board’s role in ESG oversight.

- The company discloses the Board or applicable Board Committee that oversees climate risk.

- A matrix, table, graphic or other visual elements are used to depict the distribution of specific ESG responsibilities among the Board, Board committees, and management.

- The document includes an ESG highlights/summary section using graphics or other visual elements.

- The document provides an overview of ESG focus areas and updates on key priorities and initiatives.

- The company summarizes its ESG reporting practices, including use of applicable reporting frameworks, and the website where to find the most recent ESG report.

- The shareholder engagement section includes, at a minimum: who from the company participated, how many shareholders were contacted (number of shareholders or percentage of shares outstanding), and topics discussed.

- The shareholder engagement section includes a graphic or other visual to show the timing of disclosed engagement efforts.

- The shareholder engagement section includes feedback received from shareholders and actions/responses taken in recent years.

- The director compensation section discusses benchmarking with peer companies.

- Pay mix and applicable components of director compensation (including all committee chair retainers and equity awards) are disclosed in a matrix, table graphic or using other visual elements.

- Director stock ownership requirements are discussed within the director compensation section.

- The audit section includes an overview of the audit firm selection process / assessment.

- The audit section includes a discussion of the audit committee’s involvement in the selection of the audit engagement partner.

- The audit section includes disclosure of the length of the audit firm’s engagement.

- The CD&A starts with a dedicated table of contents or similar overview of key topics and identifies the NEOs in a table or other visual format.

- The proxy summary or CD&A summary includes prior year say-on-pay results.

- If say-on-pay proposal from prior year received less than 0% support, an overview of shareholder outreach and a summary of feedback and committee response is included in the CD&A summary.

- The CD&A summary explains changes to the program for the reporting year or states that there are no changes from the prior year.

- The CD&A summary includes an overview of incentive program achievement and payouts.

- The proxy summary or CD&A summary includes a summary of key compensation practices and policies (what we do/don’t do, or list).

- The proxy summary or CD&A summary includes a table or other visual overview of components of compensation including, at a minimum for incentive programs: performance metrics; weighting of each metric; performance periods; and vesting terms.

- The document includes a table or other visual summarizing the objective/purpose of each element of compensation.

- The document includes disclosure of CEO and average NEO pay mix presented as a graphic or using other visual elements.

- The base salary disclosure includes a table, graphic or other visual element that presents change in NEOs’ base salaries year-over-year or states no change.

- The annual incentive disclosure includes a graphic explaining how the award(s) is calculated.

- Rationale for selection of performance metrics used in the annual incentive program for the applicable year is explained.

- The annual goal setting process (e.g., including how plan goals relate to the annual operating plan, guidance/forecasts or prior year performance) is explained.

- A table or graphic is used to present performance goal(s) and final results for the annual incentive program for the applicable year.

- Rationale for selection of performance metrics used in the long-term incentive program for the applicable year is explained.

- The long-term incentive disclosures include a graphic or other visual explaining how performance-based awards are calculated.

- A table or graphic showing the mix of long-term incentives is included as part of the discussion of the long-term incentive program.

- A table or graphic is used to present performance goal(s) and final results of long-term incentive programs with periods completed in the applicable year.

- Current payout percentages (i.e., “tracking” based on performance to date) for outstanding equity awards are disclosed in a table, graphic or using other visual elements.

- The CD&A includes a consolidated discussion or presentation of each individual NEO’s role, performance and total direct compensation (e.g., “NEO pay summary” or “scorecard”).

- Peer group disclosures include criteria used to identify peer companies and a matrix, table, graphic or other visual element showing how the company compares to peers with respect to the criteria.

- The CD&A includes a table, graphic or other visual element showing stock ownership guidelines for the CEO and other NEOs.

- The CEO and other NEOs’ compliance or noncompliance with stock ownership guidelines is disclosed.

- CEO pay ratio and pay versus performance disclosures are included in the Table of Contents (or in separate Executive Compensation Table of Contents).

- The pay versus performance section includes graphics to demonstrate the relationship between compensation actually paid (CAP) and applicable financial metrics.

B. Transparency Criteria: Form 10-Ks

Here is the set of 26 criteria that companies can use to make their Form 10-Ks more transparent:

- The document is available in PDF print format (not only a PDF of the HTML).

- There is an interactive version that includes links to navigate to and from sections of the document, including table of contents.

- There is a table of contents on page 2 with two levels (chapters and subsections) of detail.

- The document follows a logical structure recommended by the SEC.

- Each section of the report is labeled with the appropriate name from the regulations (i.e., “Risk Factors,” “Management Discussion and Analysis,” etc.).

- Every page footer or header includes the company name, document title and year and relevant section.

- | The document includes a secondary color.

- Item 1 – Business contains an overview of the company’s strategy.

- Item 1 – Business includes a graphic to highlight company strategy.

- Within Item 1, there is a direct link to the website hosting all of the company’s SEC filings.

- Within the human capital management section, there is a subsection on diversity and inclusion.

- Within the human capital management section, there is a subsection on employee recruitment and retention.

- The company discloses employee turnover metrics.

- Within the human capital management section, there is a subsection on employee training and development.

- Within the human capital management section, there is a subsection on employee health, wellness and safety.

- Within the human capital management section, there is a subsection on culture and engagement.

- The company discloses global workforce statistics on gender.

- The company discloses workforce statistics on race.

- The company discloses whether the Board or applicable Board Committee receives reports or summaries of any cybersecurity risk assessments conducted by a third party.

- The company discusses environmental issues in the context of risk.

- The company discloses whether the Board or applicable Board Committee receives reports or summaries of any climate scenario risk assessments conducted by a third party.

- The segments in the Business Overview are an exact match to the segments discussed in the MD&A.

- The MD&A contains at least one graphic to highlight company performance.

- The tables throughout the MD&A have titles.

- The Notes to Consolidated Financial Statements have a dedicated table of contents.

- The document contains a Glossary of Terms or Key Word Index.

C. Transparency Criteria: ESG Reports

Here is the set of 75 criteria that companies can use to make their ESG reports more transparent:

- The company publishes an ESG report or provides a website that summarizes its ESG activities, in either case that is updated at least annually or bi-annually (for companies that publish multiple reports and/or provide website disclosure, the company must provide a summary or highlights document with direct, clearly-identified links to information across its other reports/website).

- The company provides an interactive document with links to navigate to and from sections of the document, including table of contents.

- Every page footer or header includes the company name, document title and year and relevant section.

- The document includes a one-page table of contents that includes two levels of hierarchy.

- The document has an “about this report” section that gives context for understanding narrative and numbers in the report including at a minimum: the report dates; boundaries (geographic or other); and voluntary ESG frameworks or standards used.

- The company provides a contact for ESG-related information or questions.

- The company states whether it has a Chief Sustainability Officer or similarly titled position and who that position reports to.

- The document includes an introductory letter discussing how ESG is integrated into company strategy from either the CEO, the Board or Chief Sustainability Officer (or equivalent).

- The mission, vision or purpose is disclosed somewhere within the introductory pages.

- The company discusses how its overall ESG strategy aligns with the company’s mission, vision or purpose.

- The “about the company” section includes, at a minimum: an overview of products/services; areas of operations and number of employees.

- The “about the company” section includes graphics or other visual elements.

- An overview of ESG “materiality” includes how “material” ESG topics were determined and prioritized.

- Stakeholder engagement is discussed, including stakeholder groups engaged, type of engagement and frequency.

- The document includes a graphic or discussion of the company’s value chain (e.g., full lifecycle of the business or service, including upstream and downstream business relationships and dependencies).

- Within the introductory pages of the report (or of each applicable section), the document includes a summary of its ESG commitments/goals and progress to date.

- Graphics or other visuals are used throughout the report to show performance against key quantitative goals (at least three goal-related graphics).

- ESG strategy is presented as aligned with UN Sustainable Development Goals.

- The document includes an overview of the company’s overall strategy and policies related to the environmental issues identified in its report.

- The document discusses the board’s role in oversight of climate risks and opportunities.

- The company explains how it identifies, prioritizes and manages climate risks and opportunities.

- Climate risk scenario analysis results are presented or shared via a link to a separate report.

- Scope 1 and 2 emissions data is reported year-over-year (unless inaugural report).

- Scope 3 emissions data for reporting year are disclosed.

- Glide paths are provided for emissions target goals.

- Greenhouse gas/carbon emissions reduction targets are quantitatively disclosed.

- The company discloses that Greenhouse gas/carbon emission targets have been approved (or are in process of review) by the Science-Based Targets Initiative (SBTi).

- The company shares how it will meet Scope 1 and Scope 2 goals and targets.

- The company shares how it will meet Scope 3 goals and targets.

- *The company discusses its approach to biodiversity.

- *The company discusses its approach to circularity/waste (recycling/reducing waste).

- The company discusses expectations of suppliers to adhere to its environmental standards.

- *The company discusses its approach to water management.

- *The company discloses information about assessing water impacts in sensitive areas.

- The document includes an overview of the company’s overall strategy and policies related to the social topics identified in its report.

- Company culture and values are presented.

- Global workforce statistics (full time, part time, and by region) are presented.

- The company provides a link to its latest EE0-1 report.

- There is a section or subsection on diversity, equity and inclusion.

- DE&I goals are disclosed.

- DE&I progress against goals are disclosed.

- The company provides a summary of its actions around its DE&I goals and targets.

- Graphics are included to represent gender at the board, senior leadership and associate levels.

- Graphics are included to represent race/ethnicity at board, senior leadership and associate levels.

- Pay audits and/or pay equity (how often, how gaps are fixed, etc.) are discussed.

- Voluntary and involuntary turnover rates are disclosed.

- There is a section or subsection on employee training and development.

- *There is a section or subsection on employee safety.

- There is a section or subsection on employee wellness, well-being or mental health.

- There is a section or subsection on employee engagement.

- The document includes an overview of the company’s strategy and commitment to human rights.

- There is a link or summary of the company’s human rights policy.

- There is a link or summary of the company’s supplier code of conduct.

- Supply chain audit processes are disclosed.

- The company discusses how it gives back to communities in which it does business and/or employees live (volunteering, philanthropy and foundations, employee giving, partnerships, etc.).

- The dollar amount of charitable giving, by type, in the current reporting year is disclosed.

- The document includes an overview of the company’s overall approach to governance topics identified in its report.

- The document discusses the board’s oversight of the ESG topics discussed in the report, including board committee oversight.

- A table, graphic or other visual elements are used to depict ESG board oversight.

- The company explains how its enterprise risk management (ERM) process includes the assessment/evaluation of ESG topics.

- The company discusses its ethics and compliance culture.

- The company states whether it has a Chief Compliance Officer or similarly titled position and who that person reports to.

- The document includes a summary of the topics covered in the code of ethics/code of conduct or list of related policies.

- Open reporting process is discussed, including anonymous reporting programs and anti-retaliation policies.

- Ethics/code of conduct training requirements are disclosed, including who is trained and how often.

- The company provides an overview of its overall strategy and policies relating to cybersecurity.

- The company states whether it has a Chief Information Security Officer or similarly titled position and who that person reports to.

- Information security (cyber/data privacy) training is disclosed, including who is trained and how often.

- *Discussion of approach to product safety, including methods for reporting complaints.

- Policies related to political activity or public policy engagement are disclosed.

- The company provides a list of trade association memberships, engagement in national or international ESG processes, or other partnerships around material ESG issues, especially those related to industry sector (e.g., involvement in climate policy or SEC disclosure regulations).

- The company provides a third-party assurance/verification letter(s) for, at a minimum, GHG emissions.

- The company provides a SASB index and TCFD index, or alternatively an ISSB (IFRS) Index.

- The company provides performance data tables as part of the appendices, section summaries or with a clear link provided to those tables on the company’s website.

- GHG methodology is explained, including at a minimum: what standards followed (such as GHG Protocol) to understand assumptions; financial, operational or other type of control used; entities/assets excluded and why; and any other assumptions needed to understand full context of GHG emissions shared in report.

D. Transparency Criteria: IR Websites

Here is the set of 25 criteria that companies can use to make their IR websites more transparent:

A search for “Company [This Year’s] Annual Report” on any search engine will lead to the current Annual Report in the top five results.

A search for “Company [This Year’s] Proxy Statement” on any search engine will lead to the current Proxy Statement in the top five results.

- The homepage of the corporate website includes “Investors” or “Investor Relations” with other prominent level one headings.

- There is an ESG, Sustainability or Corporate Responsibility section clearly identified and accessible from the IR homepage.

- There is a Company Overview or About section clearly identified and accessible from the IR homepage.

- The company’s leadership is clearly identified and accessible from the IR homepage.

- An overview of the board’s composition, which is located in the Corporate Governance or Governance subsection.

- A subsection within the Investor page is called “SEC Filings” and includes a PDF and HTML version of filings.

- SEC Filings are searchable by type of filing (such as annual reports, proxies, -Ks).

- A subsection within the Investor home page is called “Corporate Governance” or “Governance.”

- The home page of the “Investor” section includes, at a minimum, “Events and Presentations,” “stock Information,” and “contact or FAQ.”

- The “Events and Presentations” page includes future and past events in chronological order, including archived transcripts or presentations.

- The “stock information” page includes the company’s ticker and stock quote information.

- The “contact” page offers an option to send an email to investor relations or a specific contact in Investor Relations.

- Readers can access the 10-K from the IR home page in two (or fewer) clicks.

- Readers can access the Proxy from the IR home page in two (or fewer) clicks.

- There is a dedicated website or landing page for the Annual Meeting that includes all materials needed for the AGM.

- The IR site offers easy and public access to the annual meeting webcast or transcript.

- Annual Reports and Proxies from at least the last five years are available on the IR site.

- Readers can access the Code of Ethics or Code of Business Conduct from the IR home page in two (or fewer) clicks.

- The company’s current bylaws are posted and easily accessed.

- The IR section offers an option to register for email alerts.

- The Investor Relations search engine should be quick and accurate.

- The company website’s search engine provides easy access to information related to “ethics,” “strategy” and “sustainability.”

- Readers should be able to view and download the company’s latest earnings presentation.

E. Transparency Criteria: Codes of Conduct

Here is the set of 29 criteria that companies can use to make their codes of conduct more transparent:

- A search for “code of ethics or code of conduct company name” in any search engine will lead to the most recent document in the top three results.

- The most recent version is found in the Ethics or Corporate Governance section of the corporate website.

- The document is available in print PDF format.

- The document is available in an interactive format, sending the reader to additional content such as a video or intranet for more information.

- If the document is translated, the translated documents are available on the same landing page as the English version on the corporate website.

- A list of the different code(s) or policy(ies) are available on the same landing page as the primary code.

- Document name is either Code of Ethics or Code of (Business) Conduct.

- The document is dated and produced or updated within the last two years.

- The document includes a one-page table of contents with two levels of hierarchy.

- The document includes an introductory letter from the CEO and/or the CCO.

- The letter mentions (i) the importance of ethics, compliance and integrity, (ii) following the code, and (iii) reporting a concern.

- The document includes a section about the purpose of the code and who it applies to.

- The document explains the process for requesting waivers.

- The company values are presented at the beginning of the document.

- The Code addresses anti-corruption and ethical business practices.

- The Code summarizes its anti-harassment policy.

- The Code covers employee behavior expectations, including at a minimum, anti-discrimination, conflicts of interest, financial reporting, insider trading and use of company assets.

- The Code addresses confidentiality and information security.

- The document includes a chapter/paragraph on code violations.

- The section on reporting violations includes at least three ways (such as hotline, in-person or email) to report a concern, and includes the ability to report anonymously.

- The document says the company has a policy that prohibits retaliation against people who report concerns.

- The company presents the governance structure of the ethics and compliance program.

- The document refers to other related policy(ies).

- The document includes direct link(s) to other related policy(ies).

- The document uses personal pronouns (we, you) rather than titles (the Company, every employee).

- There are at least three graphics or infographics within the document.

- The document includes at least three practical case studies/examples (Q&A).

- The document includes a decision-making tree graphic.

- The document includes a graphic depicting the reporting procedure.