Transparency Criteria #46 for the proxy states:

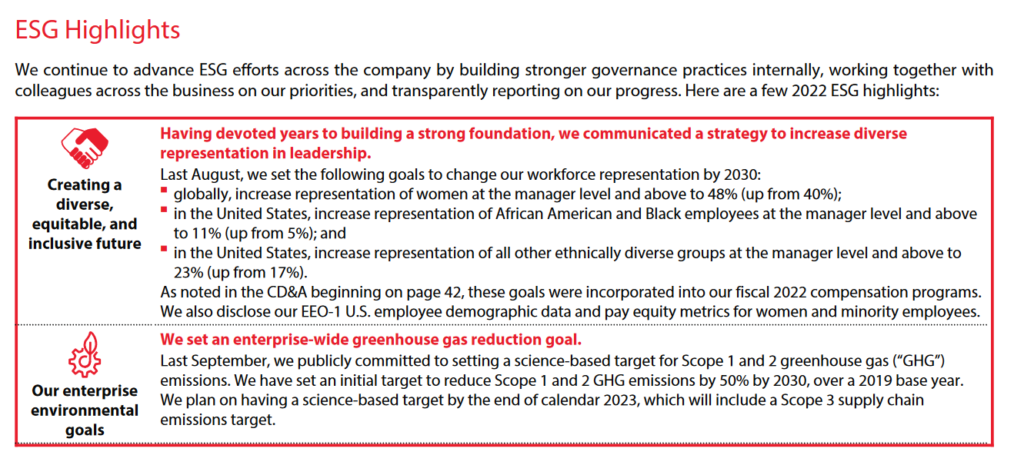

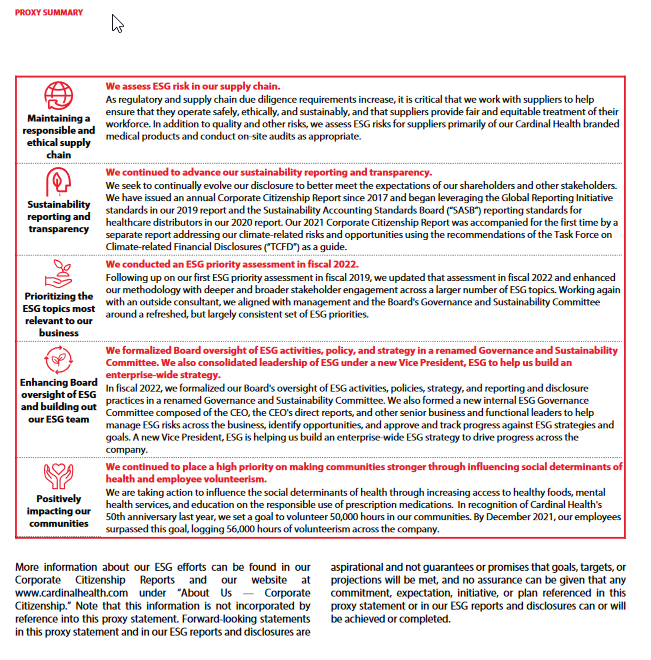

The document includes an ESG highlights/summary section using graphics or other visual elements.

And Transparency Criteria #47-48 for the proxy states:

- The document provides an overview of ESG focus areas and updates on key priorities and initiatives.

- The company summarizes its ESG reporting practices, including use of applicable reporting frameworks, and the website where to find the most recent ESG report.

I’ve written about highlight sections in previous blogs. The point of including an ESG summary is to provide readers with a gist of the company’s approach to help them make their voting decisions. The reader essentially wants to do two things: (1) a gut check review of the company’s ESG strategy so they can see if it feels right; and (2) understand if the company’s ESG initiatives are moving forward at a reasonable pace. Providing the URL where the most recently issued report can be found allows those interested in the details to easily find them.

Meet Investor Expectations

The proxy’s ESG disclosure should cover the topics that investors are most asking about. One biggie is which ESG reporting framework(s) or standard(s) does the company use. This gives a sense of company commitment to consider materiality, perform risk assessments and share metrics on key topics. In recent years, several large institutional investors have nudged companies towards SASB and TCFD reporting.

Consistency Between the Proxy and ESG Report

The ESG report typically has its own summary where it often covers “Material Topics.” That ESG report summary probably is a good place for the drafter to look when thinking about what might be covered in the proxy’s ESG disclosure. There should be consistency between the documents about what is considered material to the company when it comes to ESG. It can be helpful in the proxy to briefly explain how topics were considered and which topics were identified as priorities.

Also consider that a company might have a fairly large number of ESG goals. The most important ones (to the company, to investors or ideally both) are the ones that should find their way into the proxy’s discussion of ESG. Net zero and other greenhouse gas reduction goals, DE&I workforce goals, and reporting and policy enhancement goals are common proxy disclosures. You don’t want to replicate the ESG report in the proxy just because that’s easy to do.

Location Within the Proxy

It doesn’t matter where the ESG summary is placed within the proxy. Some companies include it in their highlights up in the front as part of the proxy summary; some place it further back in a stand-alone ESG section. Some companies even do both. The idea is to provide the reader with some sense of the company’s ESG strategy without forcing them to take the time to find the company’s ESG report to learn that.

For example, see the 2022 Cardinal Health proxy (pages 11-12):