Transparency Criteria #22 for the proxy states:

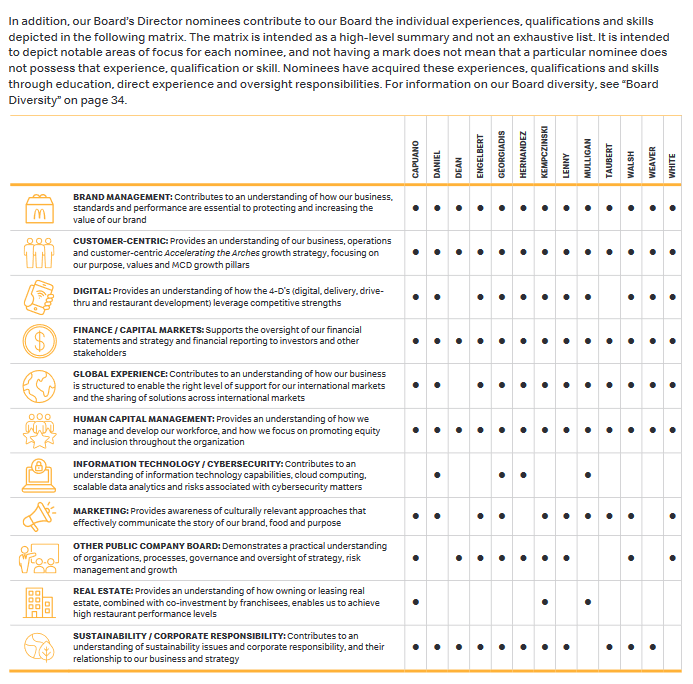

Board skills are presented in a matrix or table indicating the skills held by each individual director.

Transparency Criteria #23 for the proxy states:

Board skills are presented in a matrix, table, graphic(s), or using other visual elements indicating the skills held by the board in the aggregate.

A board skills matrix touches multiple Pillars (you’ll be learning about our five “Transparency Pillars” soon enough): “Precision” – because this is what investors want to see; “Comparability” – because it helps with a comparison with peer companies.

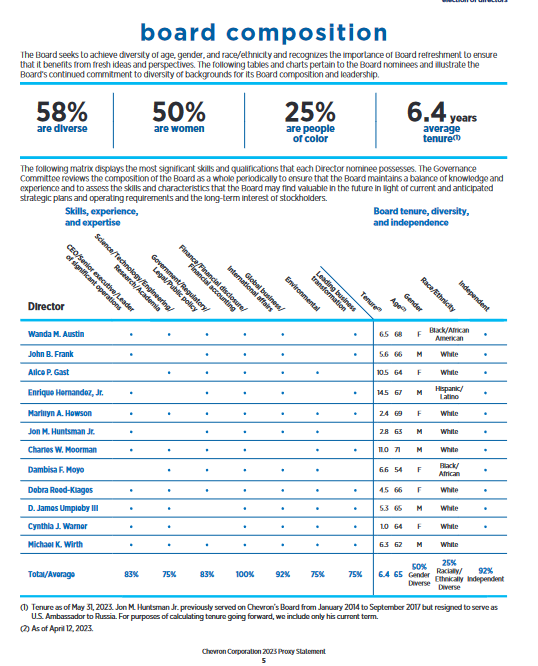

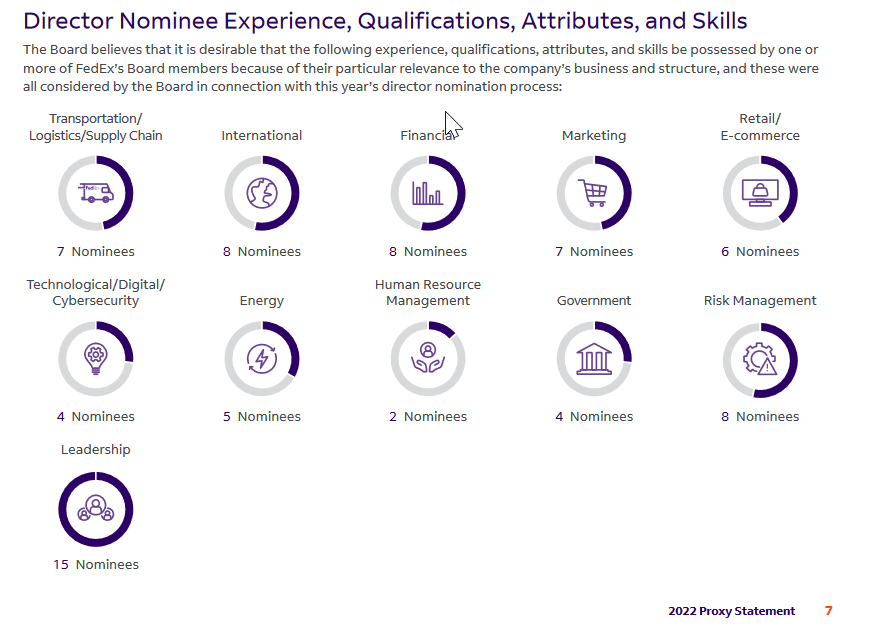

As covered earlier in blogs about the board summary table and the board demographic summary, the board skills matrix is again part of the “board snapshot” concept. A good matrix will cover not only the various skills of individual directors, but also the aggregated skill set of the board as a whole. This enables investors to get a good read on each director – and also get a feel for the entire board at a glance.

Perhaps an investor is looking to see if particular skills are represented on the board. Or maybe it’s a gut check to see if the entire board feels balanced. “Does this feel right?”

One decision that companies have to make is whether to cover individuals vs. the entire board in a single matrix. Quite a few companies decide to have two matrices to provide this information. An individualized director matrix and a full board matrix. Each approach works fine so long as a company is providing the information to investors in a clean, simple format that’s easy to understand.

For a good example of it in a combined format, see Chevron’s 2023 proxy (page 5):

For a good example of it presented in two separate formats, see FedEx’s 2022 proxy (page 7 for the aggregate format; page 24 for it in an individual format):

When the board and nominating committee is thinking about director recruitment, the key is making disclosure that shows that they have a thoughtful process that makes sense and considers the company’s strategic evolution. And that the process is one that’s not just designed to meet investor expectations. Board composition is one of the board’s primary tasks and a board can’t simply react to outside pressures to fulfill that obligation. Some companies indicate a particular skill was desired when they added a new director.

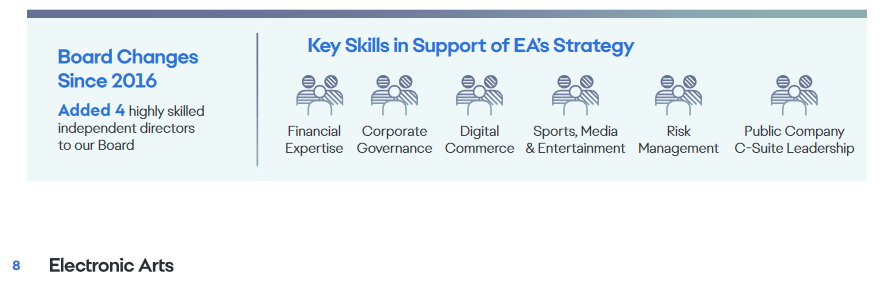

For an example of displaying how key skills support corporate strategy, see Electronic Art’s 2022 proxy (bottom of page 8):

Discussion of Why Skill is Relevant

Transparency Criteria #23 for the proxy states:

The relevance of each board skill and its link to company strategy is explained.

More recently, there has been increased buzz about a better explanation of skills. This is a natural outgrowth of the SEC’s pending climate and cybersecurity (and coming human capital) rulemakings which would elicit greater detail about directors who indicate they have a background in these areas.

For example, it might not be enough to just describe a director’s skill simply as “Technology,” “CEO” or “Risk.” There might have to be further detail that fleshes out whether a particular director is truly an expert in that area or merely has some limited exposure. “Is it leadership experience? Or more technical?”

When it comes to skills that are governance-related, there tends to be a more generic description of what that means, which makes sense, given what governance is all about.

The latest push by some investors has been tying the skills matrix to corporate strategy. “How is the board composition changing to match a changing corporate strategy? What new skills are the new directors bringing to the table?” Companies are wise to put together disclosures that highlight that they’re aware of the need for change and acting upon it in this way.

This can be done in a variety of ways, including (1) describing the skills in a way that is specific to corporate strategy and the current initiatives of the company (such as McDonald’s or HP latest proxies); (2) adding a “new” skill indicator to the matrix (such as Healthpeak’s latest proxy); and/or (3) disclosing skills looked for in new directors (such as GE’s latest proxy).

Here is McDonalds’ 2023 proxy illustrating this (page 19):