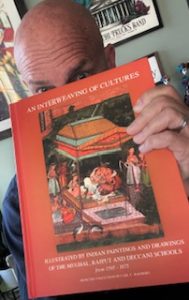

I’m just back from the “Securities Regulation Institute” in San Diego and I had the good fortune of running into John Olson, the former Gibson Dunn legend who I’ve always admired so much (see this podcast I taped with John a while back about his illustrious career).

Seeing John reminded me about this important speech that John delivered a decade ago about “The Risks of Not Shooting Straight” which bears reading as I believe it touches on the concept of “transparency” even though that term isn’t mentioned. Here is an excerpt:

“But I think this provision makes a point that we need to bear in mind and that is that the corporation is the result of a social compact between society, as represented by our government, and those who manage and invest in the corporation.

This goes back to the royal compacts and charters that were given to the great companies that opened up exploration around the world from Western Europe, which includes some of the organizations that created the states that we live in.

The corporation has always had, and I think we tend to forget this, a public purpose; a bargain has been struck between those of us as citizens and the government that represents us and investors and managers.

And the bargain is: that this corporate vehicle which has been the engine of so much of our economic growth and which has made the American capital system the envy of the world, as we have perfected this instrument I think better than anyone, is this:

We made corporations easier to form, easier to understand, easier to invest in, better regulated, traded on markets that are better regulated and more transparent than anyone else, and that’s all good. But what has happened and I see it still happening despite Dodd Frank, despite the SEC’s new rules, despite our best efforts at disclosure, is that the public is losing confidence in the integrity and the legitimacy of this incredibly creative central instrument of our capital system.

That troubles me greatly, it troubles me as a law professor, it troubles me as somebody who’s been practicing law by next June for 50 years, and it troubles me as someone who has the opportunity to be in boardrooms and talk to directors all the time. I can tell you it is bothering the members of your boards of directors.

They’re not feeling as good about themselves, even when companies are doing reasonably well, as they used to. They’re feeling beleaguered; they’re feeling unfairly criticized: they’re saying what is it that is causing this constant criticism? You read it in the press, you hear it by politicians, and you see it in election campaigns: corporations have become whipping boys – whipping girls and boys.

So what do we do about it? Well I think you have an opportunity, you as advisors have an opportunity, and that is to help to explain why compensation is what it is, but also and, very importantly, as advisors to those who are in management, are in the boardroom – an opportunity to help them think through how the plans they’re coming up with are going to be understood and received by a critical public.

If we don’t get it right, if we don’t have an environment where our citizenry, not just employees, not just investors, but communities, voters, your relatives and mine, our neighbors, have confidence in America’s companies and those who manage them, if the view of the citizenry is that corporations are being managed primarily for the greed and aggrandizement of the managers, that historic social compact that created this wonderful engine of our economy is going to be broken and we’re going to see something we’ve seen in other countries: Companies that are heavily state run, regulation that is going to stifle innovation, a loss of confidence in our economic system.

We are coming out of a very, very deep recession, as you all know we’re making progress slowly. But what do we hear? We hear that the greedy folks that run the big banks and other big companies were getting paid throughout this recession, and are still getting paid very well, even though they take a little nick now and then when something goes seriously wrong, while the rest of us have yet to recover the value of the investments that we had at the beginning of the recession. That’s not a scenario that we want to live in.

So, I think it’s important not just to say, “well I want to do what ISS or Glass, Lewis requires to avoid a negative Say-on-pay recommendation,” or “I want to talk to my large shareholders to be sure they agree with our approach to compensation.” These are important things to do. But we also need to step back and take to heart some of the lessons that our dear friend of many years Jesse Brill taught us years ago: we haven’t talked about tally sheets a lot lately, we haven’t talked about total compensation.

We need to think about those things and get away from just marking up last year’s CD&A. We need to start thinking about what are we telling, not just investors, not just those mischievous activists that we find annoying at times and worry about, but what are we telling the community, the nation that we live in about how we’re going about our business, and, more importantly in your area and mine, how we’re perceived as treating all of the constituencies that the corporations that we advise and serve, as opposed to a small group of important senior managers, who, in the eyes of most of our fellow citizens, in many cases are being over-compensated for what is not always superior performance.”