As part of our blog series based on this great panel of in-house practitioners – featuring Healthpeak Properties’ Carol Samaan, Lumen Technologies’ Michael Rouvina and Cognizant’s Aya Kiy-Morrocco – here’s a blog that addresses the question of: “Any other disclosure tips to offer?”

Healthpeak Properties’ Carol Samaan

- Keep a log throughout the year so that anytime someone has an idea or sees a nice sample disclosure or there’s a new rule – or just anything that we want to keep track of – we’ll enter it into our shared log. It could be something like an investor asked a question about something or a board member mentioned something.

So we keep this detailed log and it’s very helpful when we go to start drafting to the next year’s document and be able to rely on that. You’re not trying to remember “what were we talking about six months ago?” – and so that’s a helpful practice we’ve started. - Whenever there’s a new disclosure or new requirement, try to get it in front of the senior management team or the board sooner rather than later so that there are no surprises. We’ll often preview drafts of newer disclosure so that they have ample time to review it and we’re not trying to change things at the last minute.

Lumen Technologies’ Michael Rouvina

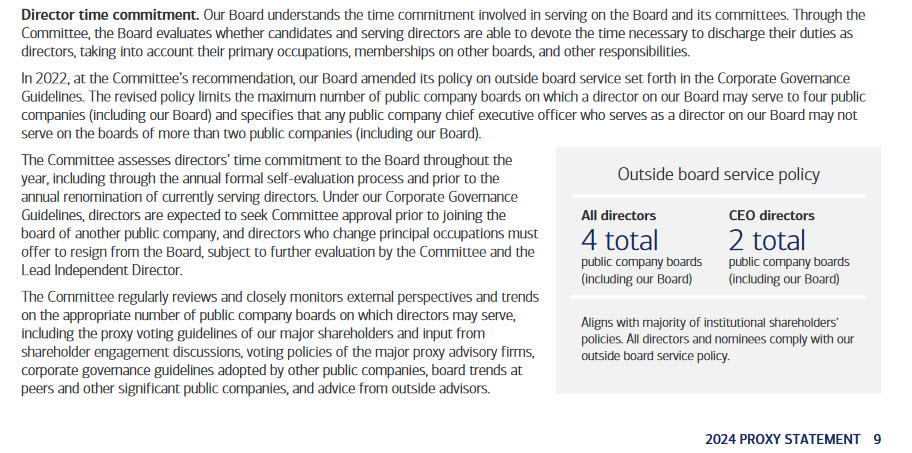

3. Having an effective shareholder engagement program. I’m not sure enough people put sufficient stock into the valuable insight you can glean, particularly during the fall engagement when you’re beginning to draft your 10-K and proxy disclosures. We get tremendous insight from some of our institutional investors as to what they’re seeing at other companies.

It saves some time for the benchmarking aspect of things. We get good insight into what they’re expecting to see in the upcoming proxy disclosures. We get good insight into what they’d like to see us do more effectively. Or where they want us to be more succinct with some of our 10-K and proxy disclosures.

4. Don’t forget to involve those internal stakeholders. If you’re looking to update your cyber disclosure like we are this year because of the new rules, it’s getting our risk and security team involved, getting our internal audit team involved. Getting them involved early rather than spin your wheels and start drafting things that may not be spot on. Talk to people to find out what it is that you should be saying and talking about specifically so you’re not wasting your time – or the time of your business partners.

Cognizant’s Aya Kiy-Morrocco

5. Start earlier. We’ve found that every year we try to move up our timeline a little bit simply because we see more regulations coming down the pipeline that at some point – for the pieces of the ESG report – might be required to be included in your proxy or annual report. There’s a specific time when that disclosure needs to happen.

6. If you want to involve your stakeholders, you need more time to be able to have those discussions and you don’t want deadlines breathing down your neck because people tend to not do their best work when that’s the case.

7. Build contingencies into your timeline. We build in weeks of contingencies into our timeline when we start. Yet, I’ve never ended a reporting cycle with leftover contingency time.