As part of our blog series based on this great panel of in-house practitioners – featuring Healthpeak Properties’ Carol Samaan, Lumen Technologies’ Michael Rouvina and Cognizant’s Aya Kiy-Morrocco – here’s a blog that addresses the question of: “When updating a section of disclosure, what are you looking for to change? How much diligence do you conduct?”

- Healthpeak Properties’ Carol Samaan – We take a fresh look if it’s the proxy statement or ESG report from start to finish and just think through a few issues. We’ll look at the investor and stakeholder feedback we received throughout the year.

Were they looking for a little more information or was something not clear to them? We’ll start with those sections they identify and try to rework them a little bit. I also apply a keen eye when we’re reviewing our disclosure to determine whether this text could stand to benefit from a graphic instead of being text heavy. Can we streamline the disclosure? Give it bullet points or make it a little bit more readable? Can we get to the punchline a little bit more quickly?

Then likewise I’ll look where we have a lot of graphics or charts and ask myself whether it is clear. Are we telling the story clearly here or have we gone too far in the direction of graphics and charts? Do we need to add a little bit of narrative here?

So we’ll do that and then we also work internally with those who are reviewing the proxy or the ESG report and ask them to help us make sure we’re ticking and tying every number, every fact and make sure it’s telling our story. We always go back and make sure that whatever we’re saying ties back to our strategy and tells our story as a company. It’s really important to make sure they’re all in sync. - Lumen Technologies’ Michael Rouvina – For disclosure that feels dated or doesn’t paint a complete picture, I focus my attention on how things could be worded differently to make it more clear and concise. I ask what is the message we are trying to convey.

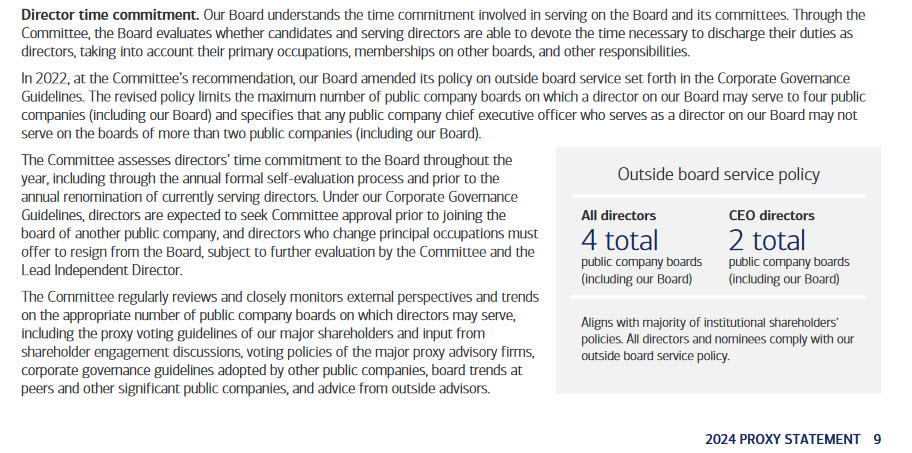

For areas where we’re maybe not telling enough of the story or if we want to reframe how we are describing the business, I make sure we relate the disclosure back to our strategy or our vision. For diligence, I get a baseline by looking at peer disclosures. Are we disclosing more or less than our peers? If so, what’s the reason for that generally?

When I decide what areas we are going to look to update this year – whether it be in the 10-K or the proxy – I’ll run those things past other internal stakeholders. Our accounting team, our internal audit team, and just make sure we’re all aligned on what’s going to get updated this year.

There’s a lot of other parties internally that are reviewing this and I want to make sure we’re focusing our energy on the right things at that particular moment in time. Once I go through those checkpoints, I have a good sense of what to move forward on for that particular filing. - Cognizant’s Aya Kiy-Morrocco – When updating a section of disclosure we are looking to update either because some new guidance has come out or because we have more information and/or we have matured. We’ll start by focusing on ensuring the integrity of the data. We want to make sure that we can back it up with evidence – so conducting due diligence by going through internal audit validation or sometimes external assurance.

We will also look at whether it makes sense to put new controls in place for the new updated disclosure because we want to make sure that whatever we are disclosing is something that is repeatable, that is trackable, that is auditable and that the information is accurate, complete, and relevant to stakeholders.